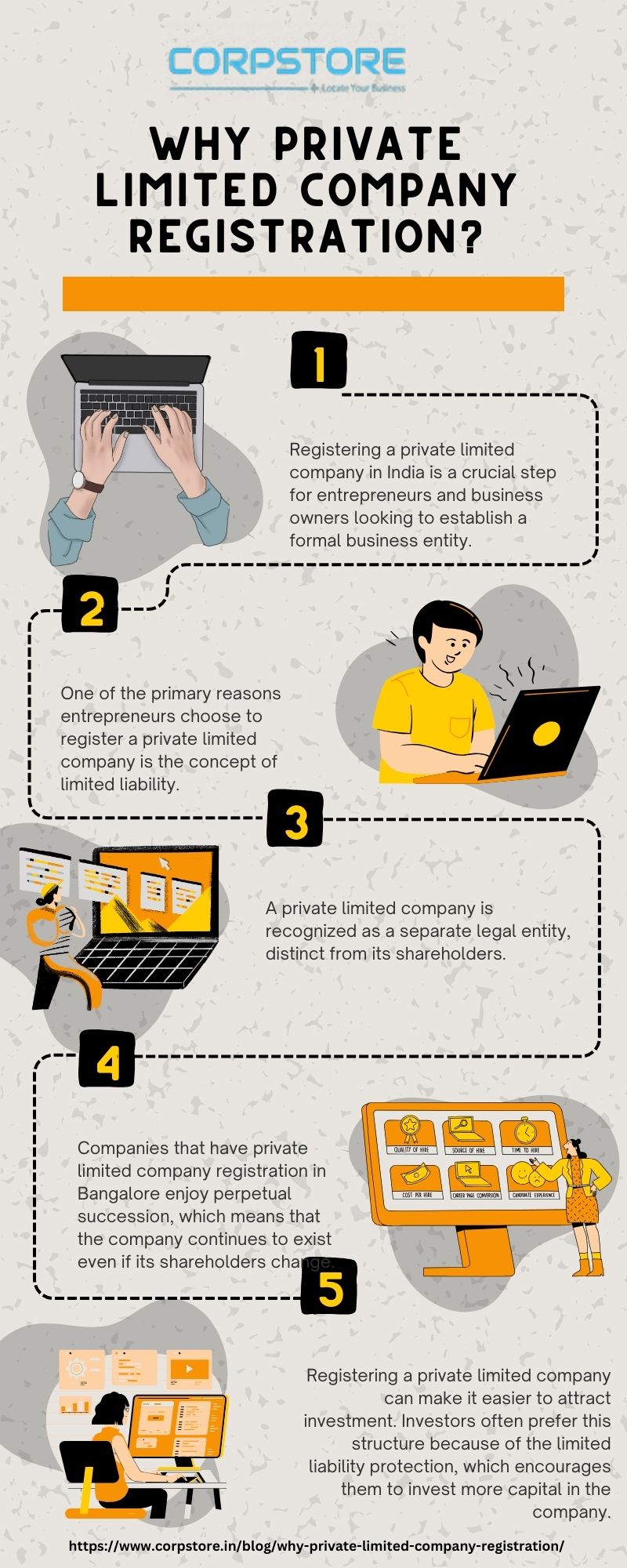

Registering a private limited company in India is a crucial step for entrepreneurs and business owners looking to establish a formal business entity. This form of business structure offers several advantages, making it a popular choice for start-ups and established enterprises.

In this blog, we will explore the reasons behind the popularity and significance of private limited company registration in India, while delving into the key benefits and steps involved.

Introduction to Private Limited Company Registration in India

A company with private limited company registration in Bangalore is a legal entity separate from its owners, offering a limited liability to its shareholders. In India, the process of registering a private limited company is governed by the Companies Act, 2013. This legal structure has become increasingly popular for several reasons.

Limited Liability Protection

One of the primary reasons entrepreneurs choose to register a private limited company is the concept of limited liability. This means that the personal assets of the shareholders are protected in case the company incurs debts, faces financial issues, or is sued.

The liability of each shareholder is limited to the amount they have invested in the company. This feature provides a safety net for investors, encouraging them to invest in the company without fearing personal financial ruin.

Separate Legal Entity

A private limited company is recognized as a separate legal entity, distinct from its shareholders. This distinction has multiple benefits. It allows the company to enter into contracts, own property, and sue or be sued in its own name.

This legal separation simplifies the conduct of business, enables better governance, and enhances the company’s credibility in the eyes of customers, suppliers, and other stakeholders.

Perpetual Succession

Companies that have private limited company registration in Bangalore enjoy perpetual succession, which means that the company continues to exist even if its shareholders change. The death, insolvency, or departure of a shareholder does not affect the company’s operations or legal standing. This stability is essential for long-term business planning and sustainability.

Attracting Investment

Registering a private limited company can make it easier to attract investment. Investors often prefer this structure because of the limited liability protection, which encourages them to invest more capital in the company. In addition, companies can issue shares, making it straightforward to raise funds through equity financing.

Transferability of Shares

The shares of a private limited company are generally transferable, subject to certain restrictions specified in the company’s Articles of Association. This allows shareholders to sell or transfer their shares without disrupting the company’s operations or requiring extensive legal processes.

Enhanced Credibility

Having “Pvt. Ltd.” as part of the company’s name adds a level of credibility and professionalism. It instills trust among customers, suppliers, and partners, which can be particularly advantageous when competing in the market. This credibility often results in increased business opportunities.

Tax Benefits

Companies with private limited company registration in Bangalore are eligible for various tax benefits and incentives in India. These may include lower tax rates, deductions, and exemptions based on the nature of the business, industry, and government policies. Companies can also take advantage of the tax benefits provided for research and development, exports, and startup initiatives.

Easy Access to Funding

Private limited companies have multiple avenues to access funding. They can raise capital through equity investment, venture capital, angel investors, and financial institutions. Moreover, they can leverage their improved credibility and limited liability to secure loans or credit lines.

Employee Benefits

Private limited companies can offer attractive employee benefits, such as stock options and employee stock ownership plans (ESOPs). These incentives can help attract and retain top talent, aligning the interests of employees with the company’s long-term success.

How much turnover is required for Pvt Ltd?

In India, there is no specific requirement for a minimum turnover to have private limited company registration in Bangalore. The turnover of a Private Limited Company can vary widely, and it depends on the nature of the business, industry, and the objectives of the company.

The concept of a minimum turnover requirement does not exist as a legal prerequisite for incorporating a Private Limited Company. Instead, the capital structure, business model, and compliance with the Companies Act, 2013, are more significant factors for registration. In this essay, we will delve into why there is no minimum turnover requirement and the factors that determine the turnover of a Private Limited Company in India.

Legal Framework

The Companies Act, 2013, governs the registration and operation of companies in India, including Private Limited Companies. This legal framework does not stipulate a minimum turnover for registration.

The act mainly focuses on the structure of the company, its shareholding, governance, and compliance requirements. The absence of a minimum turnover requirement ensures that businesses of all sizes and at various stages of development can opt for this business structure.

Business Objectives and Nature

The turnover of a pvt ltd company with private limited company registration in Bangalore largely depends on its business objectives and the nature of the industry it operates in. Some companies may start with modest turnovers and gradually expand, while others may have aggressive growth plans from the outset.

The choice to incorporate a Private Limited Company is driven by the need for a formal, separate legal entity rather than a specific turnover target.

Startup and Small Businesses

Startups and small businesses often have limited initial turnovers. They may be in the early stages of development, focusing on product development, market validation, and building a customer base.

These companies may choose the Private Limited Company structure because it offers limited liability to the promoters, access to funding, and scalability. The absence of a minimum turnover requirement is particularly beneficial for these businesses.

Conclusion

Private limited company registration in India offers numerous advantages that make it a preferred choice for entrepreneurs. The concept of limited liability, separate legal entity, credibility, and tax benefits make it an appealing business structure.

The step-by-step process of private limited company registration in Bangalore ensures that companies adhere to legal requirements and operate with transparency. Overall, the private limited company structure provides a robust foundation for business growth and sustainability in the Indian market.

Entrepreneurs seeking to establish a formal business entity in India should consider the numerous benefits and legal protections that come with private limited company registration.

By following the prescribed steps and adhering to regulatory requirements, business owners can create a stable and credible platform for their ventures.

Limited liability, separate legal entity status, tax benefits, and access to funding sources are just some of the advantages that make this business structure an attractive choice for both start-ups and established enterprises.

As India continues to promote entrepreneurship and economic growth, private limited companies with private limited company registration in Bangalore play a vital role in driving innovation and job creation while safeguarding the interests of shareholders and investors.